(Or how fiat money serves to prolong the life of capitalism while libertarians are ironically fighting to make capitalism disappear)

A great question, considering world's population rose 4.2 times from 1900-2010, annual copper mining output rose 30 times in same time period, and industrial/agricultural mass production technology (for making candy) has made exponential efficiency leaps. To investigate this serious matter lets look beyond the screams of "federal reserve and fractional lending robbed us all with depreciating overprinted fiat currency!" and delve into the underlining physical dynamics.

A one ounce Hershey's bar cost 3 cents (9 grams of copper) in 1918 whereas a 1.45 oz Hershey's bar in 1982 (last year to have 95% copper pennies) was 20.6 cents/62 copper grams per chocolate ounce. As of 2010, the Hershey's bar approximates 65 fiat cents an ounce but since the imperial authorities diluted the penny with mostly zinc (making current pennies a harder to quantify mix of zinc and copper), I'll use the 1918-1982 period for simplicity.

If one adjusts for inflation, 3 cents in 1918 is 19 cents in 1982 (539% depreciation in purchasing power). An 80 year old, lets call him Bob, getting his favorite childhood candy treat would have seen his under the mattress savings buy 6.3 less Hershey's chocolate. Now this may not seem too bad IF Bob was in a theoretical situation where his real income growth was pegged to inflation the entire life and his fiat currency grew in a bank under inflation pegged interest throughout the 20th century. Considering the candy's probable mild price buoyancy due to brand recognition, on the surface it looks like the company is only charging Bob 8% more than they did in 1918 (20.6 cents to 19).

Looking through an Austrian economics lens of inflation being an increase in the money supply, since most people do not have their finances perfectly adjusted to inflation, Bob is being continuously ripped off and impoverished via inflation tax. He may not get exactly 6.3 times less chocolate but even 2-3 less Hershey's towards the end of life is a criminal swindle.

A defender of the socioeconomic status quo in 1982 may partially agree but counter this via a pseudo-Austrian angle, "If anything Bob is lucky to only be paying 62 grams of copper per ounce instead of 9 grams in 1918 since copper is mined faster than people are breeding. He looks like he is getting a deal when using this depreciating physical metal! Copper is as fiat as paper!" (Authorities saw the copper content in penny spike more than a fiat cent in 1980-1981 period and thus changed the content, the price of copper in penny then collapsed to just under 1 fiat cent again in 1982-1984).

This is an interesting response and lets take a look at it without distracting ourselves with multitudes of other serious issues such as the government ending the use of silver in currency, going off the gold standard, stagnation of real incomes, etc. Some of these issues will begin to be resolved indirectly by the end of the article.

If one tries to look at Bob's situation via Marxist economics lens of commodity exchange, then we see that the poor fellow is being swindled in another way. This investigation is a little trickier considering technological productivity cannot be readily quantified and since the concept of productivity itself is culturally determined. What is very safe to say is that mechanical efficiency in producing an ounce of Hershey's has risen a lot more between 1918 and 1982 than the 260% rise of human population in same time period. That is, if copper production/demand magically froze in place, a 1982 Hershey's chocolate ounce should cost not 9 grams but substantially less. Surely, they've figured out ways to stamp out these chocolate treats by the millions in ways not dreamed of before (even taking into account employee salary operating expenses).

Of course copper dynamics were not frozen but they also end up benefiting Bob. If you consider the borderline exponential and evolving industrial demand for copper for electrical/water purposes throughout the 20th century, then it is clear that the 530% rise in copper production in 1918-1982 does NOT devalue 62 grams (needed to buy one 1982 Hershey's ounce) by half.

In other words, even though the copper money supply rose at twice the rate of human population, we did not see 100% inflation of the penny since the industrial demand for copper kept up pace with the human population at the very minimum. Therefore, a Hershey's bar ounce in 1982 should have cost at most 6 cents (1918 price * population growth) instead of 20.6 cents. Therefore, Bob doesn't just get ripped off through expansion of the fiat money supply but by value of goods not reflecting the breakneck pace in development of production and distribution of Hershey's bar. Considering a pre-1982 copper penny is approaching 3 fiat pennies in worth at the end of 2010 (and many countries having pulled copper from their currency in last 30 years), it may well be that a Hershey's bar should cost a lot less than a copper cent today. This makes more sense if one remembers that a silver dime from 1964 is worth over 2 dollars presently (even though annual silver output expanded 35 times in 1900-2010 period).

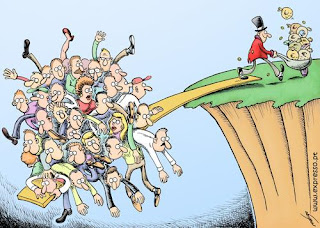

It appears safe to say that fiat currency was haphazardly introduced by business leaders in first half of the 20th century (via their political appointees) to prolong the life of capitalism via inflation. Ironically, the financial robber barons ended up doing the same thing that rural agricultural interests wanted in late 19th century America. 19th century saw various deflationary collapses and farmers wanted silver/gold bimetallism since rapid mining of silver would have introduced inflationary pressure on the dollar and thus prevented profit loss. Banksters 100 years ago were gold bugs since they made money from loans and deflation benefited the loan sharks. Since financial capitalist take over of industrial/agricultural capitalism was mostly complete by 1900, bankers tended to win political arguments.

During the great depression, there developed a compromise and some convergence of thought between financial, agricultural, and industrial interests concerning the benefits of inflation. Biggest bankers by that time, found a way to profit while expanding the money supply via modern money mechanics and farmers ended up getting governments to pay them to not produce too much and thus prevent deflationary profit loss. FDR managed to reconcile the key parasites, preserve capitalism, and artificially prolong the profit taking of major monopoly industries at the long term expense of the consumer (in a very humane developmental manner). Yes, he also did a lot of great things and is one of the kindest masters people saw in the last century (no sarcasm).

If the price of an 1982 Hershey's bar reflected the real amounts of hard money (commodity) availability PLUS availability of Hershey's ingredients (commodities) PLUS the cutting edge technological ability to produce and distribute the Hershey, then we'd see the company experience the periodic deflation born crisis of overproduction that the communist manifesto summarized. One can imagine what will happen to corporate bottom line if a copper/silver/gold/rare earth metal commodity money coin buys more consumer goods every year than the previous one. On paper, Austrian utopian capitalism is too efficient and benefits the consumer too much (so much in fact that it quickly implodes in deflationary collapse horror show, massive unemployment, and technologically driven socioeconomic evolutionary leap towards post-scarcity society).

It is little wonder that Trotsky sided with Austrian economists when he wrote of pre-requisites of United States going communist. They being commodity backed hard money utilized to barter for consumer goods. This is especially true for gold since gold production only rose 5.5 times in the 1900-2010 period, barely above population growth. Ironically, the current wave of libertarians are fighting to make capitalism disappear (since non-fiat currency would fully unleash the post-scarcity potential of means of production and distribution that have existed around us since at least the 1950s and that Buckminster Fuller and King Hubbert described in detail). I will leave with a few 1934 quotes from Leon Trotsky regarding the absolute necessity of ending the federal reserve. ;)

"-This system will be made to work not by bureaucracy and not by policemen but by cold, hard cash.

-Your almighty dollar will play a principal part in making your new soviet system work. It is a great mistake to try to mix a “planned economy” with a “managed currency.”

-Your money must act as regulator with which to measure the success or failure of your planning.

-Your “radical” professors are dead wrong in their devotion to “managed money.” It is an academic idea that could easily wreck your entire system of distribution and production. That is the great lesson to be derived from the Soviet Union, where bitter necessity has been converted into official virtue in the monetary realm. There the lack of a stable gold ruble is one of the main causes of our many economic troubles and catastrophes. It is impossible to regulate wages, prices and quality of goods without a firm monetary system. An unstable ruble in a Soviet system is like having variable molds in a conveyor-belt factory. It won’t work."

.jpg)